Tag: stock-market

-

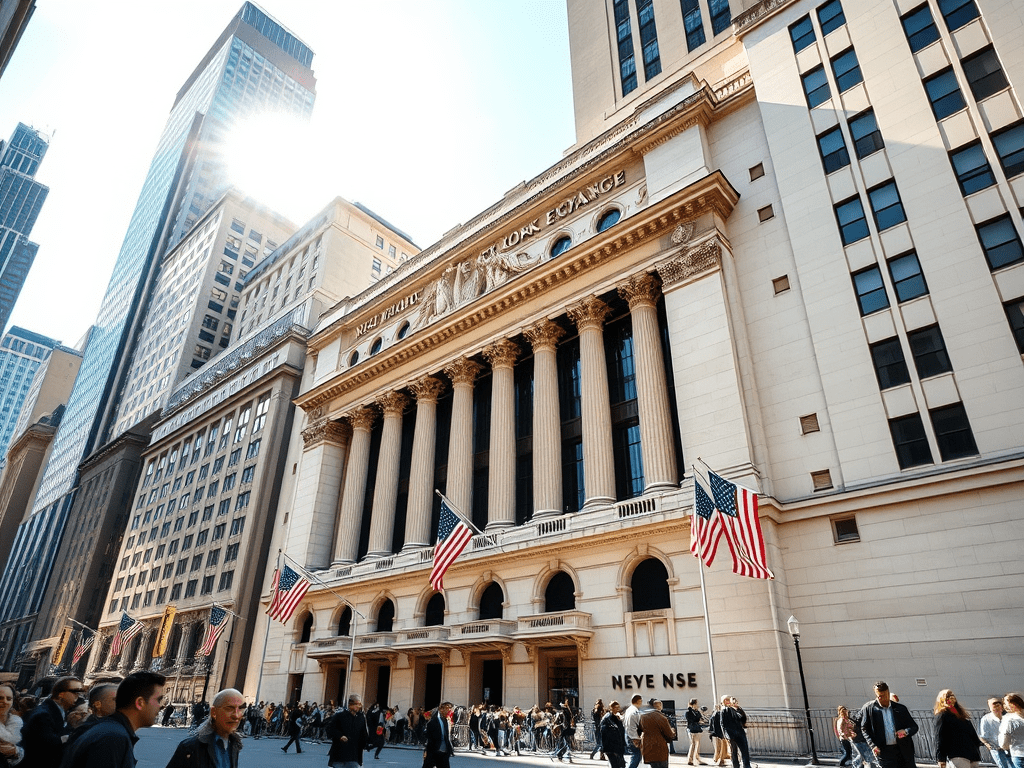

Mainsail Equity Model: It’s Time for Smart Investing

The author emphasizes the importance of focusing on stock fundamentals, especially amid Morningstar’s decreasing recommended withdrawal rates and high market valuations. Northshore Wealth Management’s Mainsail Equity Model prioritizes a focused growth strategy, proving effective in identifying thriving companies, even during market downturns. Investors are encouraged to consider fundamentals for enhanced portfolio performance.

-

Midyear Update on Our Flagship Portfolio Model

Mainsail Wealth Management’s flagship portfolio model, The Mainsail Equity Model, is currently up 11.19% year-to-date. The model is an actively managed allocation model with a buy-and-hold growth strategy, focusing on fundamental analysis and supplementing its returns through active trading based on technical analysis.

-

Fundamental Logic

The text contrasts two hypothetical traffic scenarios to illustrate stock analysis fundamentals. Predictable rush hour traffic parallels stocks with strong fundamentals, while unpredictable Saturday traffic reflects stocks driven by sentiment. The author emphasizes the importance of fundamentals in evaluating stock worth and advises hiring a knowledgeable financial advisor or learning stock analysis.

-

Conjectural Conundrum

The author expresses optimism about the stock market on May 2, 2025, reflecting on a valuation metric favored by Warren Buffet. While acknowledging that low valuations suggest potential growth, they caution against selling solely due to high valuations. They advocate for long-term investment strategies and emphasize the inevitability of market corrections.

-

Avoid This Trap in the Dip

Value investing requires discernment, especially in distinguishing quality stocks from those that are merely low-priced. Many investors mistakenly view declining stock prices as opportunities without assessing underlying quality. Compounding growth is crucial, and investors should focus on stocks that generate growth now rather than waiting for future potential, as time directly impacts returns.

-

A Practical Application of Logic

Investors often let fear of missing out disrupt their decision-making, chasing luck rather than focusing on data-driven strategies. The author discusses avoiding gambling behaviors in investing by carefully selecting high-quality stocks and timing purchases based on analysis, not chance, emphasizing a logical approach over the thrill of the chase.

-

Anything Could Happen

The author discusses Tesla’s current stock valuation, suggesting it’s overvalued with limited upside potential in the short term. Concerns are raised about the impact of CEO Elon Musk’s political involvement and the influence of retail investors from online forums. The author indicates a willingness to buy Tesla shares if they become reasonably priced, emphasizing a…