Tag: stock-market

-

Another Cold February. Another Cold Market.

February offers investment opportunities amid market volatility, promoting the value of gaining experience for investors. The post highlights the importance of enduring market fluctuations, likening it to seasonal changes that lead to future gains. Emphasizing the AI boom, the writer encourages maintaining a disciplined investment plan and suggests taking on personal challenges to foster resilience…

-

Northshore Wealth Management’s Tech Sector Outlook for 2026

The technology sector has historically outperformed the US stock market and is expected to continue doing so. While caution is advised regarding overvalued stocks, the focus should remain on well-researched tech investments within diversified portfolios. Broader diversification isn’t advocated if it dilutes effective stock allocation. Investors should prioritize smart strategies over mere index inclusion.

-

Five Investment Fears You Can Let Go of — A Free White Paper

Northshore Wealth Management’s white paper addresses common investor fears, helping individuals make informed decisions about their financial future. It discusses the impact of tax laws on investments and offers insights into time-tested strategies. The firm also provides virtual financial advice and asset management services nationwide, promoting peace of mind for investors.

-

Keep Your Assets Smart and Your Research Smarter

The author discusses finding a trustworthy financial advisor who invests their own money in the portfolios they recommend. They critique SmartAsset for promoting advisors who pay for recommendations. The author believes in providing genuine service rather than relying on paid endorsements for credibility.

-

Get to Know Alyse – Final Episode

In the concluding video of the series, the speaker shares what differentiates Northshore Wealth Management from other firms. The speaker provides insights into their approach, emphasizing the importance of a trustworthy advisor. Viewers are encouraged to evaluate their fit and reach out if interested.

-

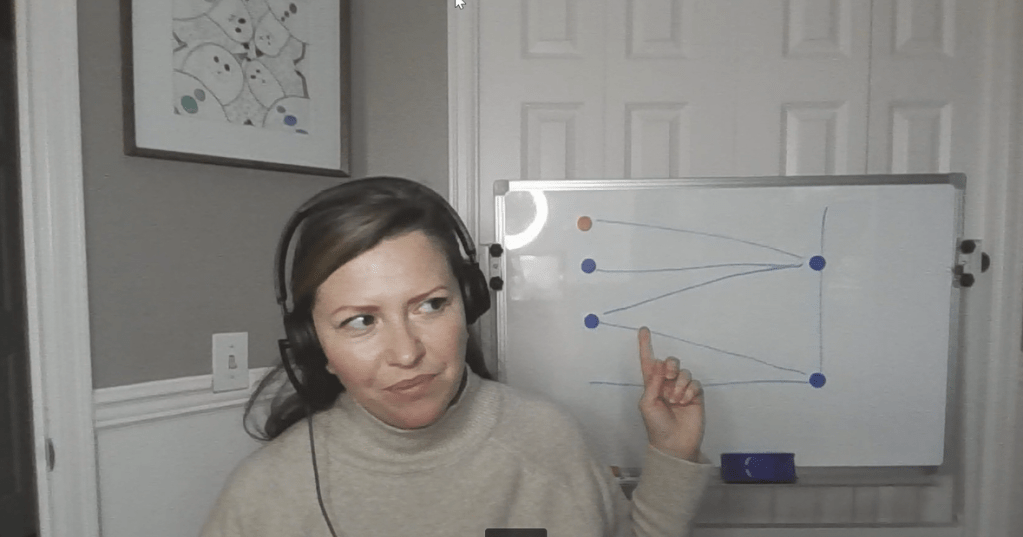

Get to Know Alyse – Part Three

The focus of content quality outweighs the significance of location or delivery. Effective communication relies on substance rather than setting. The video serves to illustrate the style of virtual meetings, covering portfolio performance and capital gains tax insights.

-

Get to Know Alyse – Part Two

This content introduces the author and their work at Northshore Wealth Management, emphasizing their 20 years of industry experience. The author aims to build trust through their insights and investment advice. They provide market insights for viewers regardless of whether they choose to hire them, highlighting a commitment to client understanding.

-

Fear is Not For Sale

Northshore Wealth Management focuses on offering advice without instilling fear in investors. They emphasize that market volatility can be capitalized on and offer various strategies to manage risk. Their approach respects individual preferences, aiming to ensure clients live well without stress. Consultations are free, with fees only for asset management services.

-

The Market is Right on Schedule

The stock market typically peaks in July, with potential pullbacks in August and September. Indicators suggest a shift toward overbought conditions, evidenced by meme stock surges. Historical patterns indicate potential downturns may occur before rallying in the fourth quarter. Northshore Wealth Management aims to leverage these fluctuations for investor gains.

-

Midyear Outlook

In the second half of the year, Northshore Wealth Management’s Mainsail Equity Model will focus on leveraging historical market trends. With a cash position nearing 10%, potential buying opportunities will be pursued around October. Positive market reactions to a corporate tax cut bill are anticipated, supporting a year-end S&P 500 target of 6,600 points.