Tag: investing

-

The Future Isn’t Here Yet

Tesla is set to lead in humanoid robot manufacturing, addressing the rising need for domestic robotic labor. While the company’s future potential is noted, current investor sentiment reflects stagnant TSLA share prices. The focus should be on capturing immediate growth rather than waiting for speculative long-term gains, prioritizing assets with current potential for profit.

-

Anti-Diversification

Mark Cuban’s assertion that diversification is for idiots misses the nuance of stock analysis expertise. While diversification can dilute growth potential, it also mitigates risk, making it suitable for average investors. The Mainsail Equity Model advocates focusing on fewer stocks for greater growth. Diversification’s value varies based on individual investor goals.

-

Sick Chickens, Healthy Consumers

The article emphasizes that public opinion does not accurately reflect economic health, as it relies on data and financial indicators. High egg prices, often seen negatively, actually indicate consumer spending and economic strength. With 68% of the U.S. economy driven by consumer spending, strong corporate earnings result from continued consumer activity despite high prices.

-

Avoid This Trap in the Dip

Value investing requires discernment, especially in distinguishing quality stocks from those that are merely low-priced. Many investors mistakenly view declining stock prices as opportunities without assessing underlying quality. Compounding growth is crucial, and investors should focus on stocks that generate growth now rather than waiting for future potential, as time directly impacts returns.

-

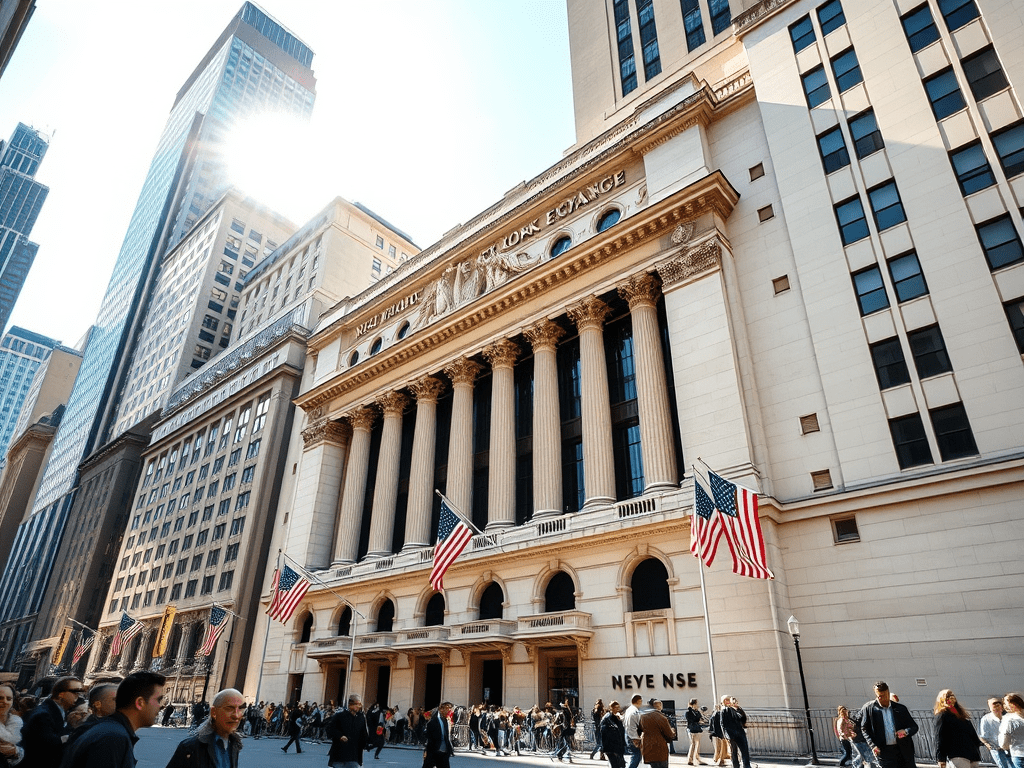

Remaining Optimistic

The Mainsail Equity Model has experienced an 8% decline, coinciding with a market correction. Emphasizing a focused allocation strategy, Mainsail remains optimistic about growth despite market fluctuations. Strong consumer health metrics indicate resilience in the economy, supporting the strategy of investing in US equities amidst pullbacks, fostering investor strength and positivity.

-

A Practical Application of Logic

Investors often let fear of missing out disrupt their decision-making, chasing luck rather than focusing on data-driven strategies. The author discusses avoiding gambling behaviors in investing by carefully selecting high-quality stocks and timing purchases based on analysis, not chance, emphasizing a logical approach over the thrill of the chase.

-

Anything Could Happen

The author discusses Tesla’s current stock valuation, suggesting it’s overvalued with limited upside potential in the short term. Concerns are raised about the impact of CEO Elon Musk’s political involvement and the influence of retail investors from online forums. The author indicates a willingness to buy Tesla shares if they become reasonably priced, emphasizing a…