Tag: finance

-

The Number One Factor in Selecting the Right Portfolio is…

A strong relationship with a financial advisor is crucial for achieving your financial goals. Advisors should engage in difficult conversations to guide clients toward sensible strategies rather than simply agreeing with their desires. A competent advisor helps clients navigate fears of market exposure to encourage growth, ensuring recommendations prioritize clients’ best interests.

-

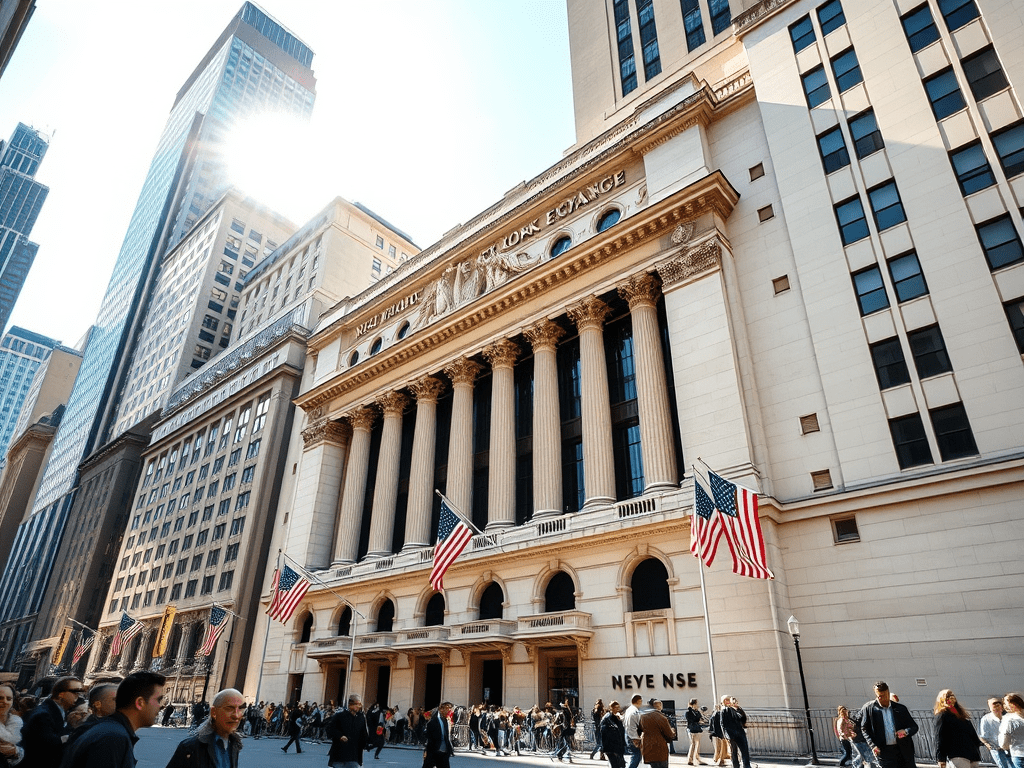

Mainsail Equity Model: It’s Time for Smart Investing

The author emphasizes the importance of focusing on stock fundamentals, especially amid Morningstar’s decreasing recommended withdrawal rates and high market valuations. Northshore Wealth Management’s Mainsail Equity Model prioritizes a focused growth strategy, proving effective in identifying thriving companies, even during market downturns. Investors are encouraged to consider fundamentals for enhanced portfolio performance.

-

Fundamental Logic

The text contrasts two hypothetical traffic scenarios to illustrate stock analysis fundamentals. Predictable rush hour traffic parallels stocks with strong fundamentals, while unpredictable Saturday traffic reflects stocks driven by sentiment. The author emphasizes the importance of fundamentals in evaluating stock worth and advises hiring a knowledgeable financial advisor or learning stock analysis.

-

Conjectural Conundrum

The author expresses optimism about the stock market on May 2, 2025, reflecting on a valuation metric favored by Warren Buffet. While acknowledging that low valuations suggest potential growth, they caution against selling solely due to high valuations. They advocate for long-term investment strategies and emphasize the inevitability of market corrections.

-

The Future Isn’t Here Yet

Tesla is set to lead in humanoid robot manufacturing, addressing the rising need for domestic robotic labor. While the company’s future potential is noted, current investor sentiment reflects stagnant TSLA share prices. The focus should be on capturing immediate growth rather than waiting for speculative long-term gains, prioritizing assets with current potential for profit.

-

Anti-Diversification

Mark Cuban’s assertion that diversification is for idiots misses the nuance of stock analysis expertise. While diversification can dilute growth potential, it also mitigates risk, making it suitable for average investors. The Mainsail Equity Model advocates focusing on fewer stocks for greater growth. Diversification’s value varies based on individual investor goals.

-

Sick Chickens, Healthy Consumers

The article emphasizes that public opinion does not accurately reflect economic health, as it relies on data and financial indicators. High egg prices, often seen negatively, actually indicate consumer spending and economic strength. With 68% of the U.S. economy driven by consumer spending, strong corporate earnings result from continued consumer activity despite high prices.

-

Avoid This Trap in the Dip

Value investing requires discernment, especially in distinguishing quality stocks from those that are merely low-priced. Many investors mistakenly view declining stock prices as opportunities without assessing underlying quality. Compounding growth is crucial, and investors should focus on stocks that generate growth now rather than waiting for future potential, as time directly impacts returns.

-

Remaining Optimistic

The Mainsail Equity Model has experienced an 8% decline, coinciding with a market correction. Emphasizing a focused allocation strategy, Mainsail remains optimistic about growth despite market fluctuations. Strong consumer health metrics indicate resilience in the economy, supporting the strategy of investing in US equities amidst pullbacks, fostering investor strength and positivity.

-

A Practical Application of Logic

Investors often let fear of missing out disrupt their decision-making, chasing luck rather than focusing on data-driven strategies. The author discusses avoiding gambling behaviors in investing by carefully selecting high-quality stocks and timing purchases based on analysis, not chance, emphasizing a logical approach over the thrill of the chase.