Category: Mainsail Equity Portfolio Model

-

“Luck is a Dividend of Sweat” – Ray Kroc

The author shares personal stories to emphasize that success in both athletics and investing requires dedication and effort. Highlighting her son’s soccer journey and investing strategies, she underscores the importance of hard work, persistence, and fundamental analysis over luck.

-

The Future Isn’t Here Yet

Tesla is set to lead in humanoid robot manufacturing, addressing the rising need for domestic robotic labor. While the company’s future potential is noted, current investor sentiment reflects stagnant TSLA share prices. The focus should be on capturing immediate growth rather than waiting for speculative long-term gains, prioritizing assets with current potential for profit.

-

Two Pieces of Good News

Netflix has seen a 17% year-to-date increase, with analysts optimistic about a 20% price target rise following strong earnings. This positive outlook qualifies it for Northshore Wealth Management’s Mainsail Equity Model. In contrast, Tesla, despite potential, doesn’t meet the criteria for inclusion in this focused growth strategy.

-

Anti-Diversification

Mark Cuban’s assertion that diversification is for idiots misses the nuance of stock analysis expertise. While diversification can dilute growth potential, it also mitigates risk, making it suitable for average investors. The Mainsail Equity Model advocates focusing on fewer stocks for greater growth. Diversification’s value varies based on individual investor goals.

-

We Stay the Course

The writer reflects on the challenges of market turbulence and shares their commitment to guiding clients through investment difficulties. They emphasize the importance of patience and the potential for growth amidst challenges, encouraging clients to remain calm and focused on long-term strategies while navigating current market conditions for recovery.

-

Remaining Optimistic

The Mainsail Equity Model has experienced an 8% decline, coinciding with a market correction. Emphasizing a focused allocation strategy, Mainsail remains optimistic about growth despite market fluctuations. Strong consumer health metrics indicate resilience in the economy, supporting the strategy of investing in US equities amidst pullbacks, fostering investor strength and positivity.

-

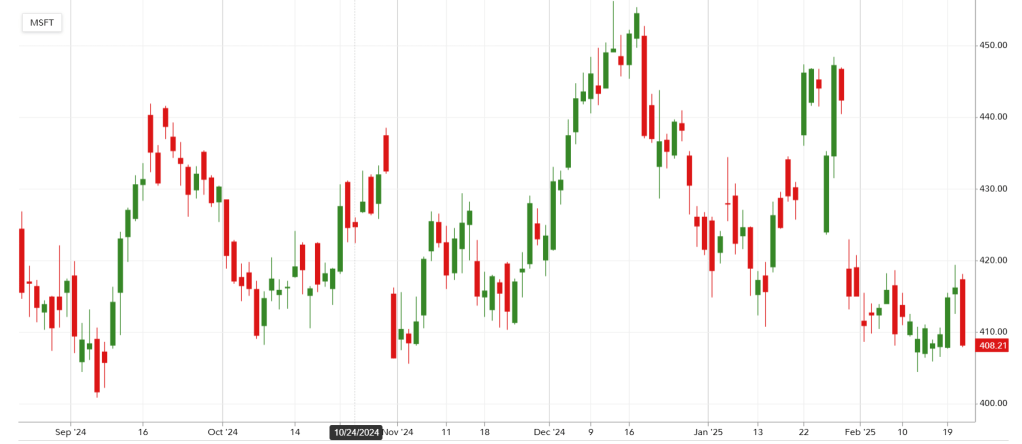

Another Man’s Treasure

The Mainsail Equity Model focuses on long-term growth through a selective portfolio of blue-chip stocks, with a strategy to invest sidelined cash when advantageous. Currently, there is an opportunity to increase the position in Microsoft. This update is for Northshore Wealth Management’s Mainsail Equity Model participants, not investment advice.

-

A Romantic Chart for Valentine’s Day

The January 21st blog post discussed the Mainsail Equity Model’s strategic deployment of cash reserves to buy Apple shares during a dip. A 10.9% gain was realized after selling those shares on Valentine’s Day to prepare for future opportunities in a choppy market.

-

It’s Game Time

Nintendo plans to launch the Switch 2 in April 2025, following the success of the original Switch, which sold 146 million units. Despite recent sales challenges, the company’s strong operating margin and a history of increased revenue with new consoles present a temporary investment opportunity for Northshore Wealth Management’s Mainsail Equity Model.

-

Opportunities Abound

The market’s reaction to a new Chinese AI company is deemed temporary, with volatility presenting investment opportunities. The Mainsail Equity Model aims to leverage price drops in selected stocks, anticipating strong earnings reports. The S&P 500 is projected to gain 14% by 2025. The focus remains on American investments for regulatory safety.