Category: Mainsail Equity Portfolio Model

-

2025 Year-End Portfolio Returns at Northshore Wealth Management

In 2025, the Mainsail Equity Portfolio Model achieved a 37.35% return, while the Regatta Strategic Option Model earned 27.19%. The Nordhavn Growing Income Portfolio increased by 11.2%, resulting in a 10.09% income raise for investors. Northshore Wealth Management emphasizes rigorous stock selection and prioritizes clients’ best interests in managing portfolios.

-

Northshore Wealth Management’s Tech Sector Outlook for 2026

The technology sector has historically outperformed the US stock market and is expected to continue doing so. While caution is advised regarding overvalued stocks, the focus should remain on well-researched tech investments within diversified portfolios. Broader diversification isn’t advocated if it dilutes effective stock allocation. Investors should prioritize smart strategies over mere index inclusion.

-

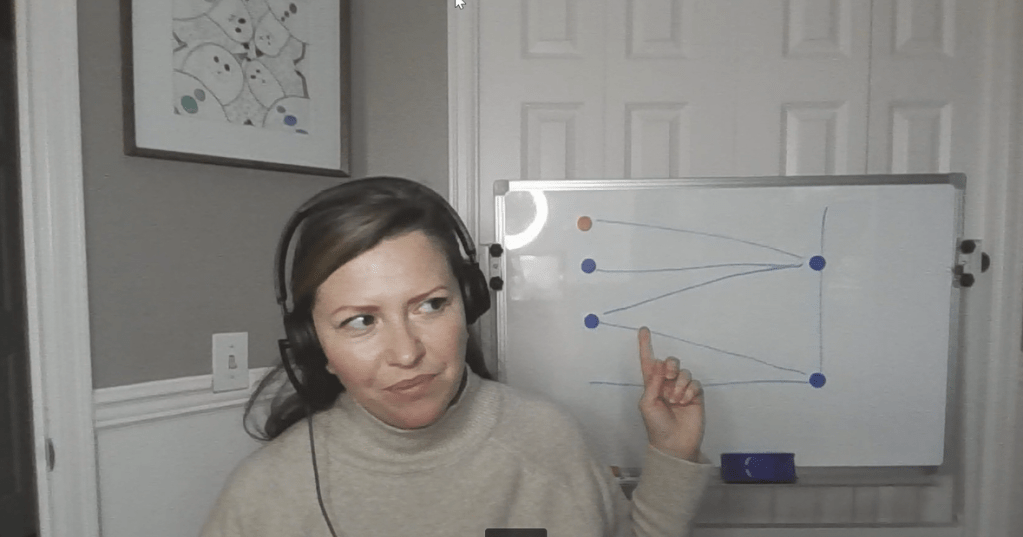

Get to Know Alyse – Part Three

The focus of content quality outweighs the significance of location or delivery. Effective communication relies on substance rather than setting. The video serves to illustrate the style of virtual meetings, covering portfolio performance and capital gains tax insights.

-

Get to Know Alyse – Part Two

This content introduces the author and their work at Northshore Wealth Management, emphasizing their 20 years of industry experience. The author aims to build trust through their insights and investment advice. They provide market insights for viewers regardless of whether they choose to hire them, highlighting a commitment to client understanding.

-

Fear is Not For Sale

Northshore Wealth Management focuses on offering advice without instilling fear in investors. They emphasize that market volatility can be capitalized on and offer various strategies to manage risk. Their approach respects individual preferences, aiming to ensure clients live well without stress. Consultations are free, with fees only for asset management services.

-

The Market is Right on Schedule

The stock market typically peaks in July, with potential pullbacks in August and September. Indicators suggest a shift toward overbought conditions, evidenced by meme stock surges. Historical patterns indicate potential downturns may occur before rallying in the fourth quarter. Northshore Wealth Management aims to leverage these fluctuations for investor gains.

-

Midyear Outlook

In the second half of the year, Northshore Wealth Management’s Mainsail Equity Model will focus on leveraging historical market trends. With a cash position nearing 10%, potential buying opportunities will be pursued around October. Positive market reactions to a corporate tax cut bill are anticipated, supporting a year-end S&P 500 target of 6,600 points.

-

Mainsail Equity Model: It’s Time for Smart Investing

The author emphasizes the importance of focusing on stock fundamentals, especially amid Morningstar’s decreasing recommended withdrawal rates and high market valuations. Northshore Wealth Management’s Mainsail Equity Model prioritizes a focused growth strategy, proving effective in identifying thriving companies, even during market downturns. Investors are encouraged to consider fundamentals for enhanced portfolio performance.

-

Midyear Update on Our Flagship Portfolio Model

Mainsail Wealth Management’s flagship portfolio model, The Mainsail Equity Model, is currently up 11.19% year-to-date. The model is an actively managed allocation model with a buy-and-hold growth strategy, focusing on fundamental analysis and supplementing its returns through active trading based on technical analysis.

-

NWM’s Proprietary Allocation Models

The Mainsail Equity Model is currently experiencing a positive YTD return, having strategically invested cash during market dips. It focuses on blue-chip growth stocks and supports additional proprietary models. Northshore Wealth Management emphasizes quality work over account quantity, offering transparent, fiduciary advice with a commitment to achieving clients’ investment objectives.