Your up-to-date coverage on portfolio models, market conditions, and investment philosophy at Northshore Wealth Management.

All rights reserved. No content from this website may be reproduced in any form without written permission from the author.

-

Another Man’s Treasure

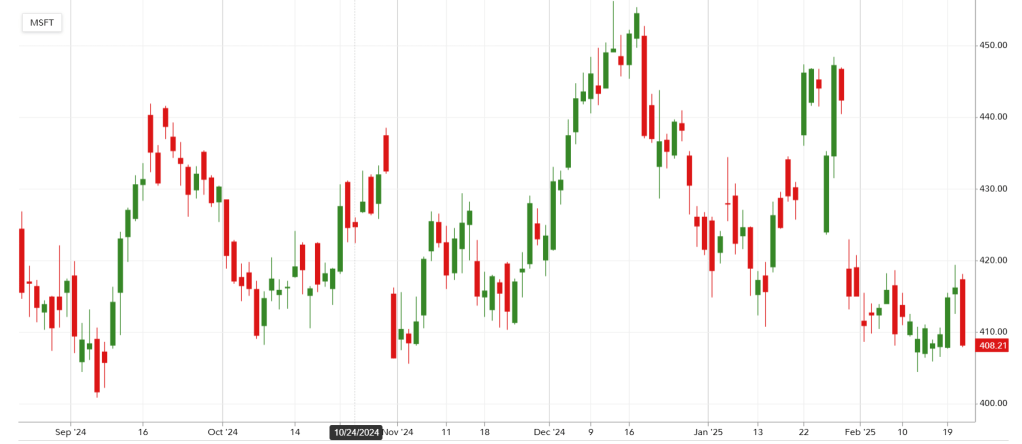

The Mainsail Equity Model focuses on long-term growth through a selective portfolio of blue-chip stocks, with a strategy to invest sidelined cash when advantageous. Currently, there is an opportunity to increase the position in Microsoft. This update is for Northshore Wealth Management’s Mainsail Equity Model participants, not investment advice.

-

A Romantic Chart for Valentine’s Day

The January 21st blog post discussed the Mainsail Equity Model’s strategic deployment of cash reserves to buy Apple shares during a dip. A 10.9% gain was realized after selling those shares on Valentine’s Day to prepare for future opportunities in a choppy market.

-

February Has a Behavioral Pattern

Historical data suggests that the second half of February typically experiences a market downturn, especially in post-election years. Investors are encouraged to view this period as an opportunity to strengthen their skills and buy strategically. With a long-term focus on growth, negative trends can be reframed positively.

-

Anything Could Happen

The author discusses Tesla’s current stock valuation, suggesting it’s overvalued with limited upside potential in the short term. Concerns are raised about the impact of CEO Elon Musk’s political involvement and the influence of retail investors from online forums. The author indicates a willingness to buy Tesla shares if they become reasonably priced, emphasizing a…

-

It’s Game Time

Nintendo plans to launch the Switch 2 in April 2025, following the success of the original Switch, which sold 146 million units. Despite recent sales challenges, the company’s strong operating margin and a history of increased revenue with new consoles present a temporary investment opportunity for Northshore Wealth Management’s Mainsail Equity Model.

-

Northshore Philosophy

The author shares their investment philosophy as a contrarian thinker, emphasizing the importance of quality over quantity in client relationships. By serving only 50 clients, they can offer personalized attention and efficient portfolio management. The advisor believes a successful financial advisor should also be a seasoned investor, prioritizing client success over the need for numerous…

-

Opportunities Abound

The market’s reaction to a new Chinese AI company is deemed temporary, with volatility presenting investment opportunities. The Mainsail Equity Model aims to leverage price drops in selected stocks, anticipating strong earnings reports. The S&P 500 is projected to gain 14% by 2025. The focus remains on American investments for regulatory safety.

-

Volatility Creates Opportunity

The Mainsail Equity Model at Northshore Wealth Management focuses on increasing its position in Apple due to current market conditions. While some investors are well-suited for market risk, others may not be. It is advised to consult a financial advisor for personal strategies. For Mainsail clients, volatility enhances opportunities.

-

You Get Out What You Put In

Personal growth is essential for health and happiness at any age, especially through learning modern technology. Embracing challenging tasks strengthens brain health and self-confidence. Key tools include YouTube for tutorials, Adobe Scan for document management, DocuSign for electronic signatures, Venmo for secure payments, and Uber for convenient travel.

Alyse Clark is a registered investment adviser in the State of Washington. The adviser may not transact business in states where she is not appropriately registered, excluded, or exempted from registration. Individualized responses to persons that involve either the effecting of transactions in securities or the rendering of personalized investment advice for compensation will not be made without registration or exemption. The opinions expressed herein are those of the firm and are subject to change without notice. Any projections or forward-looking statements expressed herein are solely those of the author and may differ from the views or opinions expressed by other firms and are only for general informational purposes as of the date indicated. Past performance of information presented should not be relied upon without knowledge

of certain circumstances of market events, the nature and timing of the investments, and relevant constraints of the

investment.

The information presented here is for educational purposes only and intended for a broad audience. The information does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and are not guaranteed. The advisor has a reasonable belief that this marketing does not include any false or materially misleading statements or omissions of facts regarding services, investment, or client experience. Northshore Wealth Management has a reasonable belief that the content as a whole will not cause an untrue or misleading implication regarding the adviser’s services, investments, or client experiences.

Northshore Wealth Management may discuss and display charts, graphs, formulas and/or stock picks which are not intended to be used by themselves to determine which securities to buy or sell or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions. Consultation with a licensed financial professional is strongly suggested.

All rights reserved. No content from this website may be reproduced in any form without written permission from the author.