Your up-to-date coverage on portfolio models, market conditions, and investment philosophy at Northshore Wealth Management.

All rights reserved. No content from this website may be reproduced in any form without written permission from the author.

-

2025 Year-End Portfolio Returns at Northshore Wealth Management

In 2025, the Mainsail Equity Portfolio Model achieved a 37.35% return, while the Regatta Strategic Option Model earned 27.19%. The Nordhavn Growing Income Portfolio increased by 11.2%, resulting in a 10.09% income raise for investors. Northshore Wealth Management emphasizes rigorous stock selection and prioritizes clients’ best interests in managing portfolios.

-

Northshore Wealth Management’s Tech Sector Outlook for 2026

The technology sector has historically outperformed the US stock market and is expected to continue doing so. While caution is advised regarding overvalued stocks, the focus should remain on well-researched tech investments within diversified portfolios. Broader diversification isn’t advocated if it dilutes effective stock allocation. Investors should prioritize smart strategies over mere index inclusion.

-

Five Investment Fears You Can Let Go of — A Free White Paper

Northshore Wealth Management’s white paper addresses common investor fears, helping individuals make informed decisions about their financial future. It discusses the impact of tax laws on investments and offers insights into time-tested strategies. The firm also provides virtual financial advice and asset management services nationwide, promoting peace of mind for investors.

-

Keep Your Assets Smart and Your Research Smarter

The author discusses finding a trustworthy financial advisor who invests their own money in the portfolios they recommend. They critique SmartAsset for promoting advisors who pay for recommendations. The author believes in providing genuine service rather than relying on paid endorsements for credibility.

-

I Give Thanks to You

In a Thanksgiving letter, Alyse expresses gratitude to her investment clients for their trust and support. She emphasizes the diligence in managing their wealth as if it were her own and the ethical freedom of providing genuine investment advice. Alyse honors their hard work and legacy, wishing them warmth in the holiday season.

-

A Retirement Income Portfolio Built to Go The Distance

This content addresses essential retirement planning questions about savings, usage, longevity, and adaptability of plans. It promotes the Nordhavn Growing Income Portfolio Model for lasting income and full flexibility and suggests the Mainsail Equity Portfolio Model for growth opportunities during the retirement planning phase.

-

Get to Know Alyse – Final Episode

In the concluding video of the series, the speaker shares what differentiates Northshore Wealth Management from other firms. The speaker provides insights into their approach, emphasizing the importance of a trustworthy advisor. Viewers are encouraged to evaluate their fit and reach out if interested.

-

Get to Know Alyse – Part Three

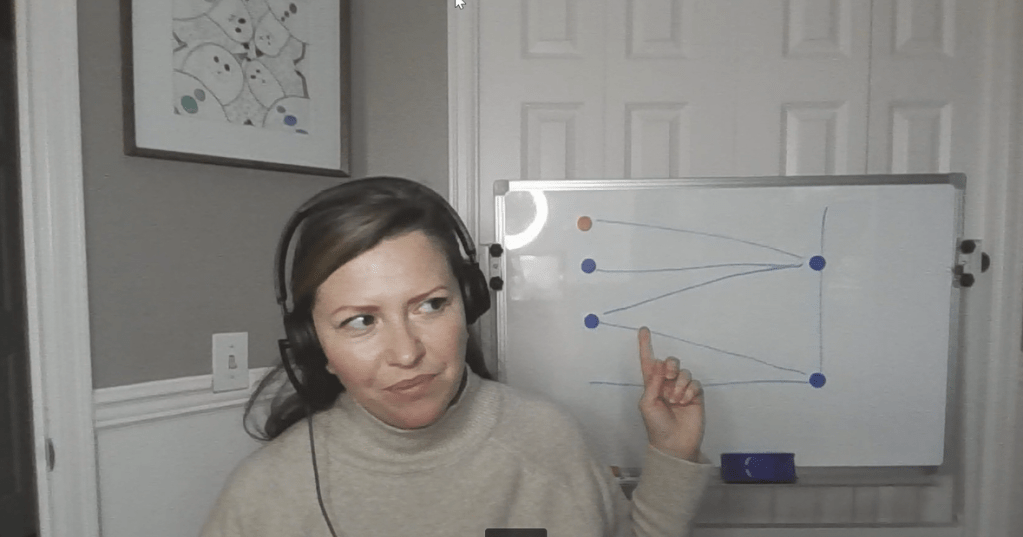

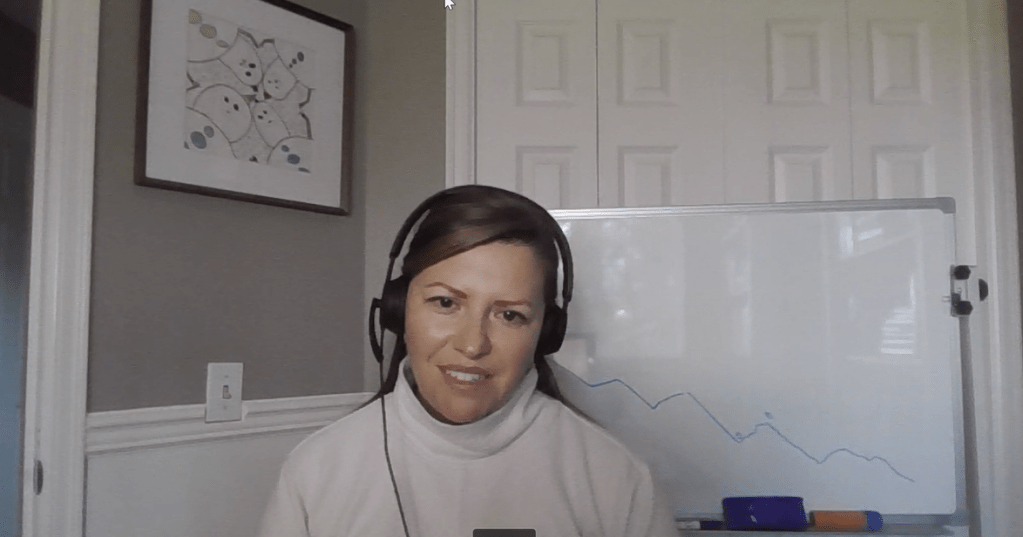

The focus of content quality outweighs the significance of location or delivery. Effective communication relies on substance rather than setting. The video serves to illustrate the style of virtual meetings, covering portfolio performance and capital gains tax insights.

-

Get to Know Alyse – Part Two

This content introduces the author and their work at Northshore Wealth Management, emphasizing their 20 years of industry experience. The author aims to build trust through their insights and investment advice. They provide market insights for viewers regardless of whether they choose to hire them, highlighting a commitment to client understanding.

-

Get to Know Alyse – Part One

The creator is producing a series of straightforward introduction videos to showcase their communication style and services as a financial advisor. They emphasize authenticity over polish, focusing on educational content and genuine human connection while managing assets. This first video serves as a no-frills introduction, highlighting their commitment to real client interactions.

Alyse Clark is a registered investment adviser in the State of Washington. The adviser may not transact business in states where she is not appropriately registered, excluded, or exempted from registration. Individualized responses to persons that involve either the effecting of transactions in securities or the rendering of personalized investment advice for compensation will not be made without registration or exemption. The opinions expressed herein are those of the firm and are subject to change without notice. Any projections or forward-looking statements expressed herein are solely those of the author and may differ from the views or opinions expressed by other firms and are only for general informational purposes as of the date indicated. Past performance of information presented should not be relied upon without knowledge

of certain circumstances of market events, the nature and timing of the investments, and relevant constraints of the

investment.

The information presented here is for educational purposes only and intended for a broad audience. The information does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and are not guaranteed. The advisor has a reasonable belief that this marketing does not include any false or materially misleading statements or omissions of facts regarding services, investment, or client experience. Northshore Wealth Management has a reasonable belief that the content as a whole will not cause an untrue or misleading implication regarding the adviser’s services, investments, or client experiences.

Northshore Wealth Management may discuss and display charts, graphs, formulas and/or stock picks which are not intended to be used by themselves to determine which securities to buy or sell or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions. Consultation with a licensed financial professional is strongly suggested.

All rights reserved. No content from this website may be reproduced in any form without written permission from the author.