Author: Alyse Clark

-

Anti-Diversification

Mark Cuban’s assertion that diversification is for idiots misses the nuance of stock analysis expertise. While diversification can dilute growth potential, it also mitigates risk, making it suitable for average investors. The Mainsail Equity Model advocates focusing on fewer stocks for greater growth. Diversification’s value varies based on individual investor goals.

-

We Stay the Course

The writer reflects on the challenges of market turbulence and shares their commitment to guiding clients through investment difficulties. They emphasize the importance of patience and the potential for growth amidst challenges, encouraging clients to remain calm and focused on long-term strategies while navigating current market conditions for recovery.

-

Playing the Hand You’re Dealt

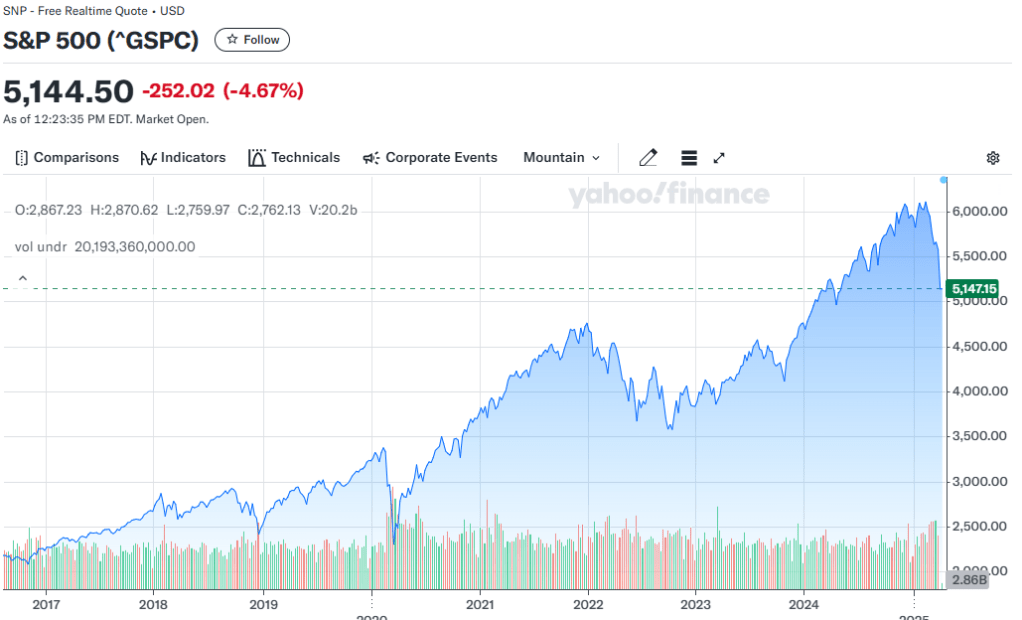

The author discusses the potential impacts of political policies on market growth, specifically under Trump’s presidency. They emphasize the importance of objective investment strategies, regardless of political bias, and highlight the effects of the 2017 Tax Cuts and Jobs Act on corporate earnings. Historical data suggests long-term investment yields significant returns despite market volatility.

-

Sick Chickens, Healthy Consumers

The article emphasizes that public opinion does not accurately reflect economic health, as it relies on data and financial indicators. High egg prices, often seen negatively, actually indicate consumer spending and economic strength. With 68% of the U.S. economy driven by consumer spending, strong corporate earnings result from continued consumer activity despite high prices.

-

Seasons of Patterns and Patterns of Seasons

The post discusses the concept of V-shaped patterns found in both markets and nature, particularly during March and April. While traditional wisdom cautions against predicting markets, the author emphasizes the importance of recognizing repeating patterns. Investors should view market downturns as opportunities rather than moments of panic, advocating for informed decision-making.

-

Avoid This Trap in the Dip

Value investing requires discernment, especially in distinguishing quality stocks from those that are merely low-priced. Many investors mistakenly view declining stock prices as opportunities without assessing underlying quality. Compounding growth is crucial, and investors should focus on stocks that generate growth now rather than waiting for future potential, as time directly impacts returns.

-

What Would Warren Buffet Do?

The content emphasizes the importance of learning from great minds, highlighting a poem by Rudyard Kipling that Warren Buffett referenced in his 2017 letter. The poem presents ideals of resilience, self-trust, patience, and humility, suggesting that mastering these traits leads to personal success.

-

Could the Storm be Over?

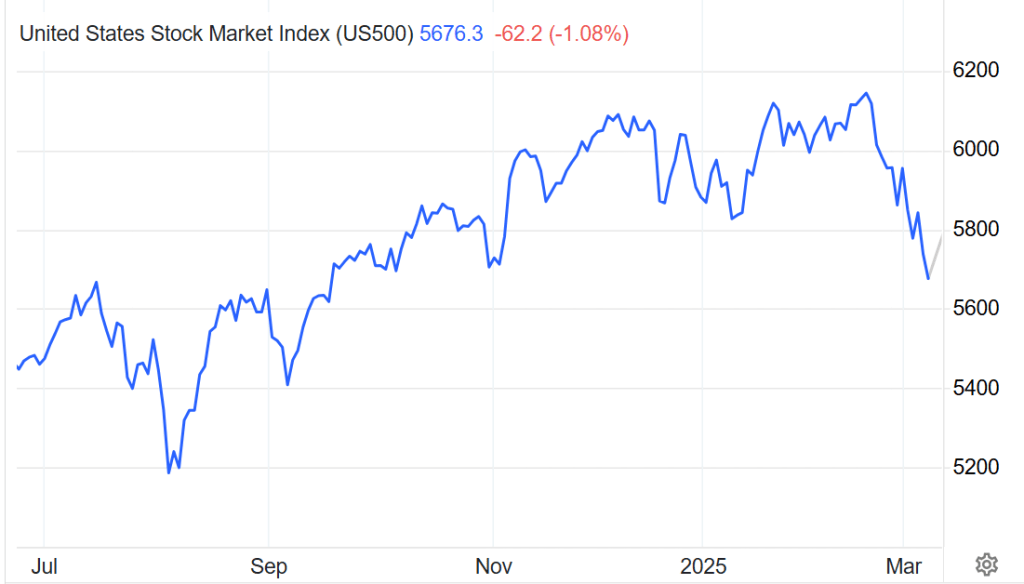

Northshore Wealth Management embraces market volatility, treating it as an opportunity rather than a setback. Instead of avoiding downturns, they advocate for strategic buying during dips. Recent market data suggests that we may be nearing the bottom of the current pullback.

-

Deja Vu

Between July 16 and August 5, 2024, the S&P 500 dropped from 4,667 to 4,186 points but rebounded to 5,608 by August 19. Market volatility is common, and recent corrections reflect a shift to more sustainable optimism. Currently, a recession is not imminent as job numbers remain stable, supporting consumer spending.

-

Remaining Optimistic

The Mainsail Equity Model has experienced an 8% decline, coinciding with a market correction. Emphasizing a focused allocation strategy, Mainsail remains optimistic about growth despite market fluctuations. Strong consumer health metrics indicate resilience in the economy, supporting the strategy of investing in US equities amidst pullbacks, fostering investor strength and positivity.