Historically, the stock market peaks in July before consolidating a bit in August and September. This is not a reason to sell in July. I’m certainly not selling. It is a reason to not be surprised by a change in performance in the coming weeks.

The fear and greed index is teetering on the edge of extreme greed in market sentiment, which usually coincides with a tipping point at which markets transition into overbought territory before reversing course into a temporary pullback.

Another overbought signal is the meme stock frenzies we’re seeing popping up again. This phenomenon usually coincides with the end of an extended rally. It says retail investors have begun partying a little too hard, and it may be time for last call.

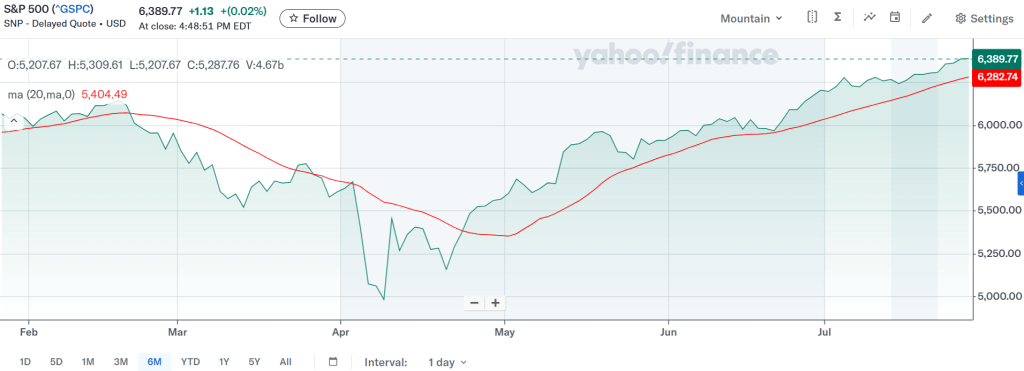

April 23rd was my birthday, and it was also the last time the S&P 500 closed at or below its 20-day moving average. A 10-day stretch above this moving average is unusual. A stretch this long is so rare you can count on one hand its occurrences in the last 75 years. The index usually crosses back and forth across its 20-day moving average frequently, and that behavior is indicative of a sustainable trend. The longer the index stays on one side of this moving average or the other, the sooner one can expect a reversal in its course.

There is no crystal ball, and no one knows precisely what’s to come. I’m not in the business of making market predictions. I am in the business of studying market data, and data suggests that we shouldn’t be surprised if the months of August and September bring us a temporary change in market direction, like they often do. Temporary being the key word. It’s common for a downturn after July to bottom in October, and the rest of the 4th quarter usually brings us some of the best market rallies of the year.

I’ll leave you with a couple of my favorite quotes from legendary market strategist Walter Deemer:

“If you need an indicator to tell you whether market sentiment is extreme, it’s not.”

And:

“The stock market will do whatever it has to do to embarrass the greatest number of people to the greatest extent possible.”

If the market behaves differently this year than historical data suggests it should, well, then that would be entirely unsurprising, just as well.

At Northshore Wealth Management, we don’t fear downturns; we capitalize on them. The only thing you can predict about the stock market is the inevitability of its volatility, so why not harness that and use it to our advantage? Our Mainsail Equity Model is strategically designed to deploy capital when opportunities arise. A downturn is the opportunity we seek, and if it presents itself, we’ll be ready to seize it, to further supplement returns for our investors.

Mainsail is our flagship portfolio model, and its YTD performance can be found here. This model is not immune to market pullbacks, and shrinkage in its return wouldn’t come as a surprise if the market behaves as expected over the next couple of months. We’ll capture opportunities as they come and use the pullback like a slingshot, with a goal of propelling us skyward. Not “to the moon”, as meme stock investors say, because rocket ships can fail, blow up, and fall out of the sky, just like meme stocks.

The goal isn’t to burn money like jet fuel. The goal is to grow it. I’ll continue working hard at it for our investors.

Live long and live well,

Alyse