In a market that has been booming, fundamentals have fallen to the bottom of some investors’ priorities. The wins were Easy. Morningstar suggests that’s changing. It may take some stagnant returns in the broader indexes before investors return to prioritizing valuations. Eventually, they’ll have to work harder for the wins. At Northshore, we’ve been working hard all along. We’ve never lost sight of fundamentals. Rather, they’re our most valued data sets.

To quote Morningstar Business Insights:

If the recommended withdrawal rate is decreasing, the balance you will withdraw from will need to be larger. To get there, you’ll need to focus on growth and how do we do that when growth is projected to slow? Growth opportunities will be less broad across the market, but they’ll still be there. To pare down our allocation, eliminating riskier valuations, we focus on fundamentals! Some equities are overvalued, but not all. At Northshore Wealth Management, we filter down and concentrate on what fits our strict fundamental criteria. It’s been my best practice for years, regardless of market valuations, but I encourage other investors to pay attention to this strategy now more than ever.

- Traditional Valuation: Equity valuation is the process of determining the fair market value of a company’s equity.

- High Valuation: A high valuation means the price of a company’s stock is elevated relative to its earnings, assets, or other fundamental measures.

- Investor Sentiment: High valuations can be driven by bullish investor sentiment, optimistic growth projections, or positive media coverage.

- Potential Risks: High valuations can mean that the stock is vulnerable to a price drop if the company’s performance doesn’t meet expectations, or it can mean that projected growth is already priced in and the share price could remain stagnant even if the company does meet performance expectations.

No stock is immune to a market correction, a pullback, or economic pressure. Good stocks will come down a little. Bad stocks will come down a lot. When a bad stock comes down a lot, most investors will realize it’s a bad stock and pull their money out, leaving that company without the financial strength to recover, or recovery will take a long time. The good stocks will recover and continue generating growth for their investors.

The S&P 500 index average is just that – an average. An average weighted performance of 500 stocks. Some are good, some are bad. The average of those good and bad stocks has yielded a growth rate of around 6% year to date. But what if we took all of the bad stocks out? What would the average be then? That’s exactly what Northshore Wealth Management does.

There are 4300 publicly traded companies in the US. To be included in the S&P 500 index, a company must meet specific criteria related to market capitalization, liquidity, public float, and profitability. Of those 500, we said no to 485. That doesn’t mean 485 of those stocks are bad ones. At least the weighted majority has to be good for the average to generate a positive return. We applied fundamental analysis and filtered by our strict criteria to skim the cream off the top based on our own research and our own insight. Only 15 made the cut.

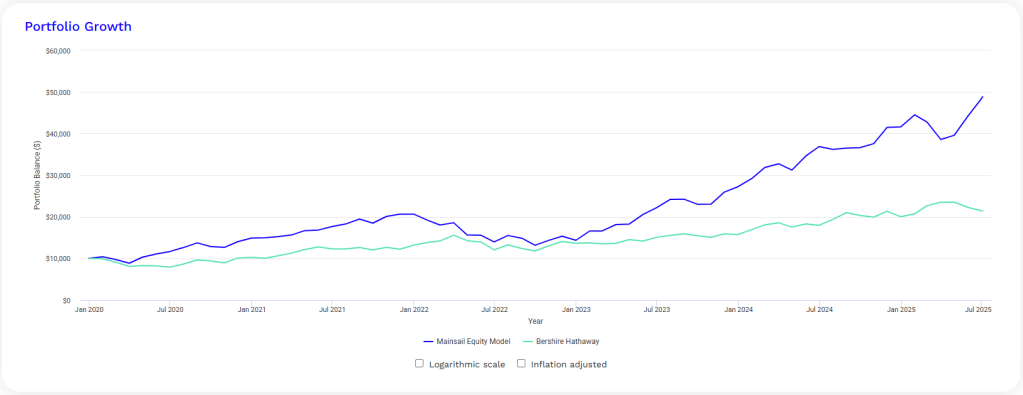

I would like to bring to your attention the value of a focused growth strategy that prioritizes stock fundamentals – Northshore Wealth Management’s Mainsail Equity Portfolio Model:

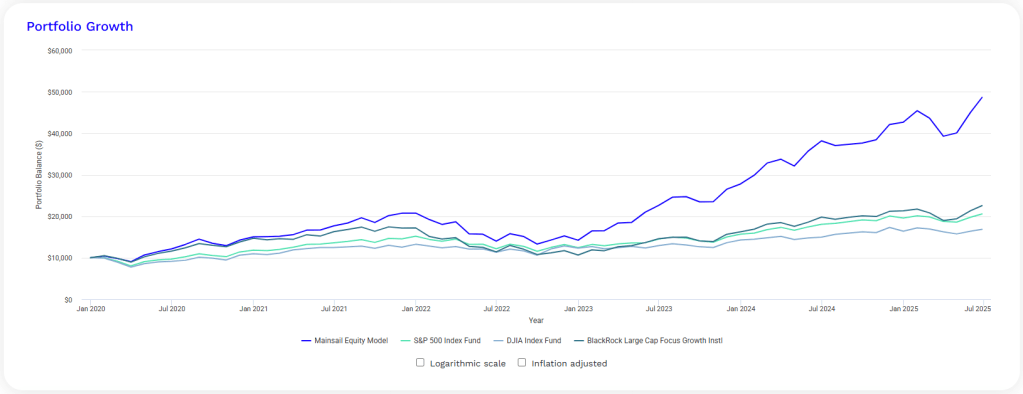

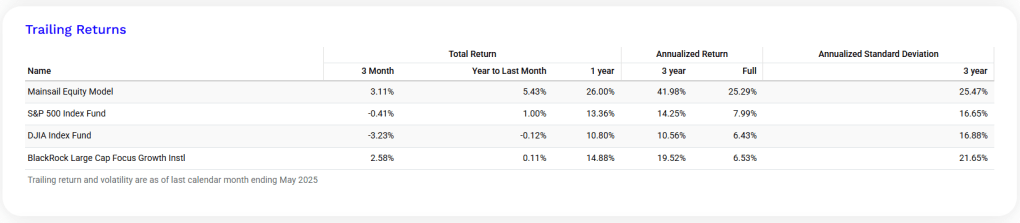

This chart measures the results of a data-driven approach to portfolio engineering against the performance of the opposite but widely popular strategy of passive index investing in the S&P 500. The Dow Jones Industrial Average is less popular but serves as a fairer comparison. The Dow is comprised of 30 domestic blue-chip stocks. Mainsail is comprised of 15 stocks, of which over 90% are domestic blue-chips. An apple to an apple. BlackRock’s Large Cap Focused Growth Fund is about as close a strategy as you can get to the Mainsail Equity Model, so we use it as a fair benchmark.

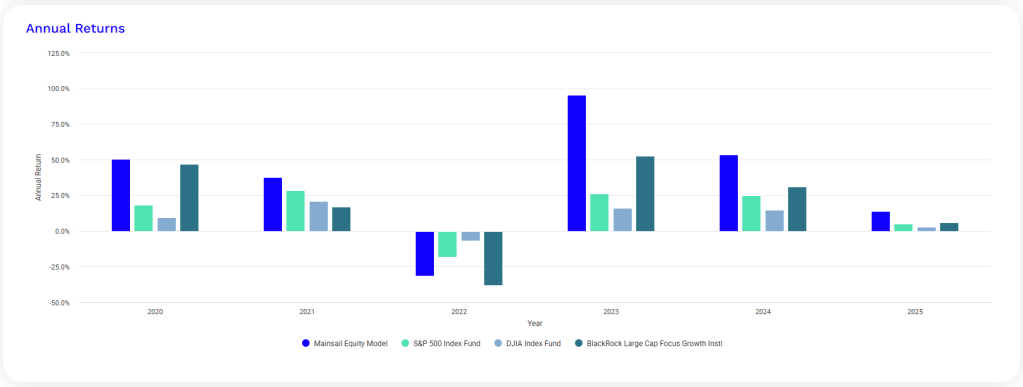

In 2023, elevated valuations started appearing in the broader market, and you can see that is where our focus on fundamentals set the Mainsail Equity Model on a different path. Not all US companies are thriving. My job, as a portfolio manager, is to identify those that are thriving and invest my clients’ money in them. My job is also to monitor current market trends, such as our current trend of elevated valuations, and give investors a strategy for current conditions.

At Nothshore, I build my own models because, in other models and mutual funds, I find stocks I wouldn’t invest in. If I wouldn’t invest in something myself, I wouldn’t advise my clients to do so. I’m not saying I’m right and others are wrong. Each of the strategies on the chart achieved growth, and some did so with less painful drawdowns.

A 36% drop is a lot to ask investors to stomach, but look back at the chart and you’ll see that even at the bottom of the worst pullback, investors in The Mainsail were still ahead of the others. Then consider all of the investors who haven’t captured this rate of growth, and that’s a lot to stomach as well. According to Forbes.com, 53% of the stock market is held in index funds. They are popular because they are inexpensive. You get what you pay for. In the chart above, Mainsail investors would have paid 1% a year in management fees for 4.5 years to end up with twice as much in their accounts as the index investors who didn’t pay management fees.

Focused growth is not a new strategy but has been overshadowed by the rise in popularity of index funds, which know how to captivate an audience with two words: “Low Cost”. Focused growth strategies have long been favored by legends like Ken Heebner and Warren Buffett. Heebner was an idol to investors when I was getting started in the 90s. As the founder of Capital Growth Management, his focused growth fund was achieving returns much like these, back then. Since 1965, Buffett has largely been overseeing the portfolio allocation of Berkshire Hathaway, which is essentially a focused strategy, with only around 38 holdings – the same number as our focused benchmark fund at BlackRock.

That makes Berkshire a fair comparison for Mainsail as well.

Berkshire Hathaway is built for comfort, and that is why it attracts so many investors. It’s the Ferris wheel of carnival rides. The Mainsail Equity Model can feel more like strapping yourself into that human slingshot. It’s not for everyone. It is our flagship portfolio model and the product of the foundational principles on which I built my investment philosophy: Investing + logic = better results.

Past performance is not indicative of future results, and a focused growth strategy may not be suitable for every investor. None of this is to be interpreted as a recommendation. Without knowing anything about you, I can’t possibly know what to recommend for you. Focused growth is just one of many strategies available to you. It can also be used in combination with other strategies to supplement a portfolio’s overall performance. Whether you ride the Ferris wheel or seek maximum velocity, I’d be happy to talk with you about strategies that suit your individual asset management wishes, needs, and comfort level. Connect with me to book an introductory meeting.