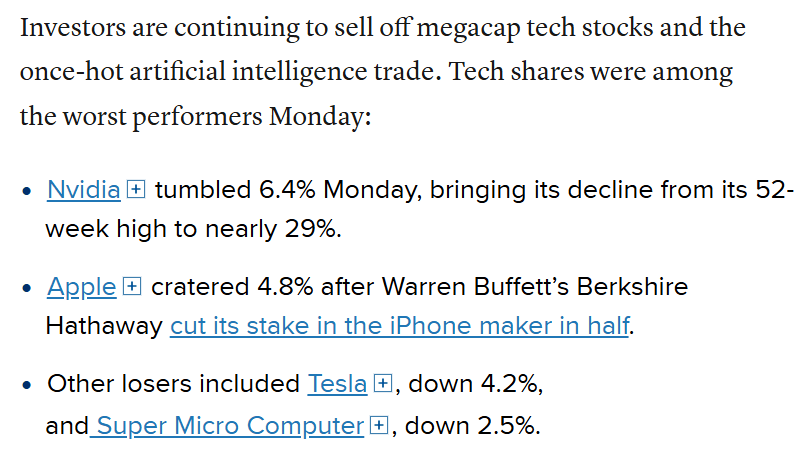

Between July 16, 2024, and August 5, 2024, the S&P 500 fell from 4,667 points to 4,186 points. Here are some news headlines and outtakes from August 5th, 2024:

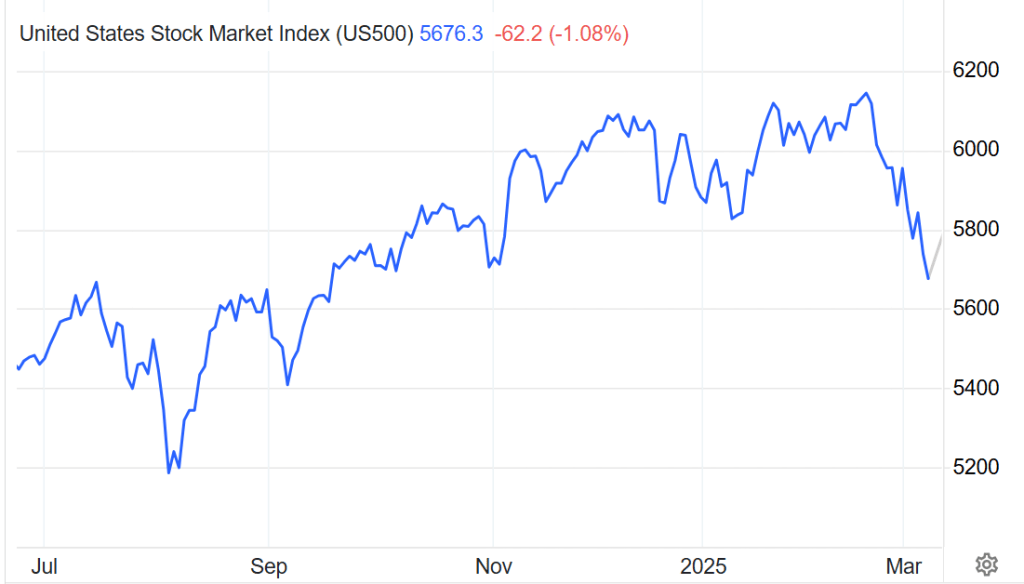

By August 19, 2024, the S&P 500 had returned to 5608 points. Here’s a chart showing August’s drop and everything since:

Here are some essential things to remember during this return to volatility:

- A 10% market correction happens almost as often as once a year. Remember that the higher an index climbs, the bigger a 10% drop will be. A 10% drop from the S&P 500’s most recent high of 6144 is 614 points. That means the index can fall all the way to 5530 points, and it’s nothing out of the ordinary.

- The first quarter of every new presidential cycle is historically unpleasant for investors while the market reacts and adjusts to a new administration.

- In recent months, many popular stocks have become slightly overpriced, and price corrections are a healthy part of market stability. I would describe this change in investor sentiment as a shift from extreme optimism to more reasonable optimism. It’s still optimism, just at a more sustainable level. Think of this part like eating your fiber and doing your push-ups and sit-ups—not fun but essential to health and fitness in your body, mind, and the market.

The word “recession” is being tossed around in the news, and there’s nothing indicating that we need to consider it yet. Whether we really need to worry about a recession boils down to jobs. Approximately 68% of the US economy is driven by consumer spending. As long as the consumer is employed, they continue to spend. When the number of jobs starts to decline, consumer spending follows suit, and that’s when we can begin discussing the risk of recession. We’re not there right now.

I can’t say what will happen next. Still, based on consumer health, unemployment rates, GDP, and accelerating corporate profits, many market strategists anticipate a V-shaped recovery like the last one. A bounce like the one we saw after August 5th isn’t something we want to watch from the sidelines. Volatility offers opportunity. Again, this isn’t me offering a prediction. I’m not a fortune teller. I’m just interpreting data, and based on historical market patterns, we could see the completion of a V-shaped pattern by mid-April. If that happens, and we zoom out on the chart, this V-shaped pattern would blend right in with all the others.